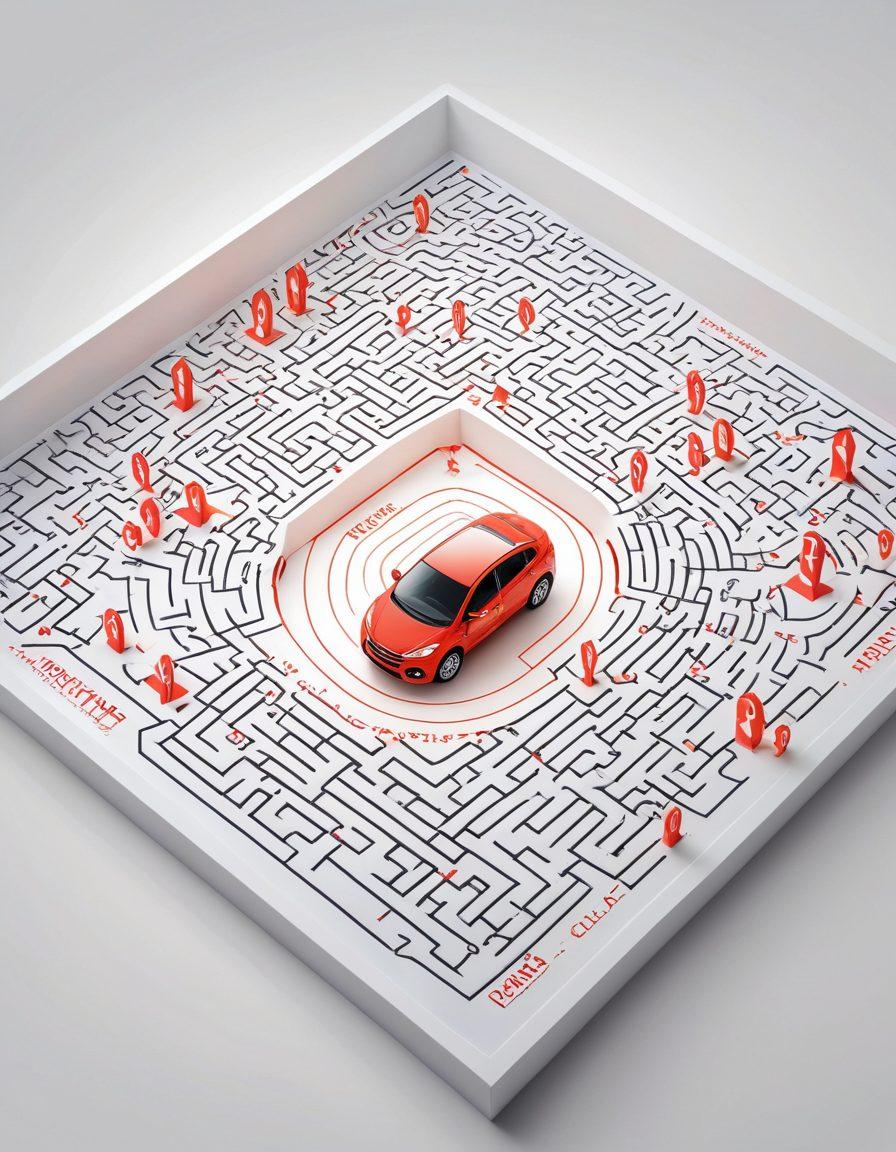

Navigating the Insurance Maze: Your Ultimate Guide to Coverage Plans and Claims Assistance

Choosing the right insurance can feel a lot like navigating through a maze—fun in theory, but overwhelming in practice. With so many types of coverage plans, premium options, and insurers out there, where do you even begin? Whether you're seeking auto insurance, health insurance, or perhaps even business insurance, understanding the intricacies of insurance coverage is crucial not only for your peace of mind but also for effective risk management. You may ask yourself, 'What if I choose the wrong plan?' or 'Am I getting the best insurance quotes?' In this blog, we’ll unlock the secrets behind choosing the right insurance and illuminate your path toward informed decision-making. Get ready to turn confusion into clarity!

Let’s start with a foundational knowledge of insurance policies. In essence, an insurance policy is a contract between you and an insurer designed to provide financial services and actual support when you need it. This contract outlines your coverage limits, premium rates, deductible options, and more. An intriguing tidbit: did you know that many people underestimate the significance of policy comparisons? Understanding the differences between policies is a vital step in ensuring you choose wisely. Ask yourself: is the coverage plan matching my needs or am I simply opting for the cheaper premium? Awareness of your own risk profile can save you from future headaches!

Speaking of needs, let’s dive deeper into the different types of insurance: from liability insurance to specialty insurance, and everything in between. Each type has its own nuances. For instance, auto insurance might not serve the same purpose as home insurance, yet each can be critical depending on your lifestyle. When exploring insurance options, it’s beneficial to consult with insurance agents or brokers to get tailored advice. They can guide you through the maze of options and help you assess your insured values, ensuring you find appropriate coverage that matches your specific situation. Do you want the peace of mind that comes with knowing you are adequately covered? Working with a professional could be your best bet!

Once you’ve gathered your options, it’s time for insurance shopping—an important step that shouldn't be rushed. Think of insurance quotes as an entryway into evaluation. Shopping around means not only looking for competitive premium rates but also understanding the coverage limits and co-pay options each plan provides. It’s a numbers game, but it's also about fit. How does each policy stack up when subjected to your individual circumstances? Conducting comprehensive insurance assessments before making a selection allows you to avoid wasting money on plans that don’t provide the necessary claims assistance when you need it most. Remember, the right insurance can be a lifesaver!

Finally, let’s touch on the importance of ongoing communication after you’ve chosen a plan. Engaging with your insurance provider should be viewed as a continual relationship, not just a one-time interaction. Utilize policyholder support to clarify any questions post-purchase and stay informed on updates and changes in your coverage. Re-evaluate your needs periodically, especially if your life circumstances change. Insurance policies should evolve just as you do. The world is dynamic, and so are your insurance needs. When was the last time you reviewed your insurance coverage? Don't let the maze swallow you whole—be proactive in your insurance journey!

Navigating Claims with Confidence: A Step-by-Step Guide to Policyholder Support

Have you ever felt lost in a sea of paperwork, jargon, and terms you just can't seem to grasp? Perhaps you've stared bewildered at your insurance policy, wondering how you would even begin to file a claim if something were to happen. You're not alone. Navigating claims can feel like a daunting task, but it doesn't have to be. With the right tools and knowledge, you can navigate the insurance maze with confidence. In this guide, we will walk you through a step-by-step approach to claims assistance, putting you firmly in the driver's seat of your financial services journey.

First, let’s set the scene. Imagine you’ve just experienced a burst pipe in your home, and you have every reason to believe your home insurance will cover the damages. You pull out your policy but quickly find yourself overwhelmed by the various deductibles, coverage limits, and clauses. The key to navigating this insurance maze is preparation. Familiarize yourself with your insurance policies, especially terms like 'insured values' and 'coverage limits.' After all, understanding your coverage plans can make the difference between a stressful claims experience and a smooth, supported process.

Now that you've done your homework, it’s time to act. But how do you move from confusion to clarity? Start by contacting your insurance agent or broker. These professionals are here to help you, and they can be your greatest allies in navigating claims. Ask questions about your premium options and deductible options, and don't shy away from discussing insurance quotes you’ve received. These conversations not only enhance your understanding but can also lead to valuable insights and tips on claims assistance. 'Knowledge is power,' and in the insurance world, this saying holds particularly true.

One of the most critical aspects of claims assistance is documentation. Once you've done your due diligence and understand your coverage, create a detailed record of anything relevant. Whether it's photographs of the damage, receipts of expenses, or notes from conversations with your insurance agent, all of these can be instrumental in supporting your claim. Think of it this way: if your paperwork is impeccable, your risk management is much more efficient. This can help alleviate stress and confusion when it’s time to submit your claim to the underwriting services as well.

Finally, stay proactive throughout the entire process. Regularly follow up with your insurance company and check the status of your claim. While this may feel tedious, keeping the lines of communication open ensures that your claim is processed efficiently. If challenges arise, don't hesitate to ask for help. Whether it's from your insurance agent or even through online forums, there's a community ready to support you. By following these steps in policyholder support, you can significantly ease the burden of filing claims and, most importantly, secure the peace of mind that comes with knowing your financial future is protected.

Understanding Your Options: From Premium Rates to Deductible Choices in Insurance Plans

Navigating the insurance maze can feel like wandering through a labyrinth with no exit in sight. With a multitude of options from premium rates to deductible choices, understanding your options becomes paramount. Whether you're considering auto insurance, health insurance, or even business insurance, this guide will illuminate the paths available to you. You might be asking yourself, 'How do I choose the right coverage plans without breaking the bank?' The answer lies in understanding the intricate web of insurance coverage and knowing how to leverage the support of insurance agents and brokers.

Imagine standing at the crossroads of insurance shopping, with different premium options beckoning from each direction. How do you know which road to take? It's essential to start by evaluating your needs, whether it's liability insurance for your business or group insurance for your family. Each policy comes with its unique coverage limits and deductible options, influencing your premium rates significantly. By conducting thorough policy comparisons and acquiring multiple insurance quotes, you empower yourself to make informed decisions that cater to your specific financial services requirements.

Have you ever heard the phrase, 'The devil is in the details?' This couldn’t be more accurate when dealing with insurance policies. It's easy to get lost in jargon; however, understanding aspects like co-pay options and insured values is crucial. Let's not forget about the underwriting services that determine the risks associated with your insurance coverage, which ultimately influences your premiums. A quote from a seasoned insurance agent rings true here: 'Knowledge is not just power; it's your best form of risk management.' This mindset can transform how you approach your insurance needs.

Once you grasp your options, the next step is to decipher your coverage limits and deductible options. Are you comfortable paying a higher deductible in exchange for lower premium rates? This is a common strategy that many policyholders find beneficial. However, consider the risks involved. How much money are you willing to put at stake before your insurance kicks in? This vital question shapes the future of your claims assistance. Remember, through effective policyholder support, you can maximize your claim's potential, easing the financial burden when life throws a curveball your way.

In conclusion, understanding your options in insurance is not just an exercise in choosing between policies, but a proactive approach to securing your financial future. As you navigate through insurance assessments and engage in conversations with insurance brokers, keep your financial goals in mind. The next time you seek insurance quotes, ask yourself: 'Am I prepared for the liabilities that come with ownership?' By embracing this knowledge, you can confidently choose the right insurance plan to safeguard your interests and that of your loved ones.